The PERILS Industry Exposure & Loss Database contains high quality and up-to-date insurance market data for natural catastrophes. It is based on data directly collected from insurance companies writing property business in the covered territories. Typical applications range from exposure and loss-based market share analysis to the validation of natural catastrophe risk models.

Industry Exposure and Loss Database

Covered Perils And Territories

Bushfire

- Australia, Canada

Earthquake

- Australia, Canada, Indonesia, Italy, New Zealand, Philippines, Thailand, Turkey

Extratropical Windstorm

- Australia, Austria, Belgium, Canada, Denmark, France, Germany, Ireland, Luxembourg, Netherlands, New Zealand, Norway, Sweden, Switzerland, UK

Flood

- Australia, Austria, Belgium, Canada, Denmark, France, Germany, Indonesia, Ireland, Italy, Japan, Luxembourg, Netherlands, New Zealand, Norway, Philippines, Sweden, Switzerland, Thailand, Turkey, UK

Hailstorm

- Australia, Canada

Tropical Cyclone

- Australia, Japan, Philippines

Volcanic Eruption

- Canada

PERILS offers industry exposure data for Indonesia, Philippines and Thailand. PERILS intends to offer event loss data and loss reporting service for Indonesia, Philippines and Thailand in future.

Australia, Canada

- Bushfire

- Earthquake

- Extratropical Windstorm

- Flood

- Hailstorm

- Tropical Cyclone (excluding Canada)

- Volcanic Eruption (excluding Australia)

Austria, Belgium, Denmark, France, Germany, Ireland, Luxembourg, Netherlands, Norway, Sweden, Switzerland, UK

- Extratropical Windstorm

- Flood

Indonesia, Italy, Thailand, Turkey

- Earthquake

- Flood

Japan

- Flood

- Tropical Cyclone

New Zealand

- Earthquake

- Extratropical Windstorm

- Flood

Philippines

- Earthquake

- Flood

- Tropical Cyclone

PERILS offers industry exposure data for Indonesia, Philippines and Thailand. PERILS intends to offer event loss data and loss reporting service for Indonesia, Philippines and Thailand in future.

For the definition of perils, PERILS follows ACORD standard (www.acord.org)

Content and Use

Per Country and CRESTA Zone (www.cresta.org)

Where available:

- Residential Property

- Commercial Property

- Industrial Property

- Agricultural Property

- Personal Lines Motor Hull

- Commercial Lines Motor Hull

Where available:

- Building Value

- Contents Value

- Business Interruption Value

Industry Exposure Database:

- Yearly updates

Industry Loss Database:

- Event loss per country available six weeks after the event and updated after three months.

- Event loss per CRESTA zone and occupancy type available after six months and updated after twelve months. Reports typically include physical intensity measures such as gust speed values.

- Further updates as deemed necessary by PERILS. Event loss reporting closed in any case 36 months after event date.

- It is PERILS' goal to include in the third and all following loss reports for each event an event intensity measure (such as modelled and observed gust values).

- Geographical resolution: CRESTA (www.cresta.org)

- Combined with market sums insured and event loss data, both available per CRESTA, event intensities allow to derive market-specific vulnerability functions or to validate the damageability function in catastrophe risk models.

- Exposure, event loss and damage degree benchmarking.

- Natural catastrophe risk model validation.

- Exposure-based business planning, pricing and accumulation control of industry-based covers (ILS, ILW).

- Design of adequate reinsurance and retrocession protections including appropriate triggers.

The PERILS Industry Exposure & Loss Database also provides an excellent basis for assessing the risk of industry loss-based (re)insurance or retrocession covers. Both the PERILS industry exposure and event loss data are based on exclusive reports provided by identical sources. By analyzing the PERILS industry exposure portfolio with a probabilistic risk assessment model, the expected loss of industry loss-based covers can be determined with an index-consistent exposure portfolio.

The PERILS industry exposure database can also be used to evaluate the correlation between multiple industry loss-based ILS/ILW commitments. As such, the PERILS industry exposure database can serve as a foundation for ILS/ILW portfolio optimization and accumulation control.

APPLICATIONS

How PERILS Industry Data is used

BENCHMARKING

The PERILS Industry Exposure & Loss Database provides new benchmarks for evaluating insurance portfolios using market exposure (sums insured) and market event loss data (insured loss amounts). Both are key market measuring sticks and complement current premium-based market position indicators. The new insights gained from this can be used in portfolio steering, claims management and strategic business planning.

For more see PERILS Industry Exposure and Loss Database.

MODEL VALIDATION

The PERILS Industry Exposure & Loss Database serves as an excellent source for validating probabilistic catastrophe risk models. Post-event risk model calibration, which is currently being carried out using a variety of sources with varying event loss estimates and industry exposure portfolios, may now be performed using the new PERILS benchmark data. In addition, by comparing the PERILS event loss data with the PERILS industry exposure, it becomes possible to derive damage degrees and to correlate them with event intensity measures provided by PERILS, such as modelled and observed gust values. This also enables the validation of the damageability function in catastrophe risk models.

For more see PERILS Industry Exposure and Loss Database.

SOLVENCY II

PERILS Industry Data contribute to risk-based solvency assessments by allowing the benchmarking of exposures, event losses and modelled losses against the market. Furthermore, custom-made triggers for fully collateralized ILS and ILW transactions are provided by the PERILS Industry Loss Index Service. In combination, this helps to address both basis risk as well as credit risk concerns, which are both central to state-of-the-art solvency regulations.

For more see PERILS Industry Exposure and Loss Database.

RISK TRANSFER

PERILS Industry Loss Index Service (Loss Indices) allows the use of PERILS industry loss estimates as triggers in Insurance Linked Securities (ILS), Industry Loss Warranty contracts (ILW) or insurance risk derivatives. The Loss Indices are based on actual insured loss information collected directly from insurance companies writing property business in the affected territories. Structured triggers, with the use of weighting factors per CRESTA, country and/or Line of Business, can significntly reduce basis risk.

For more see PERILS Industry Loss Industry

METHODOLOGY

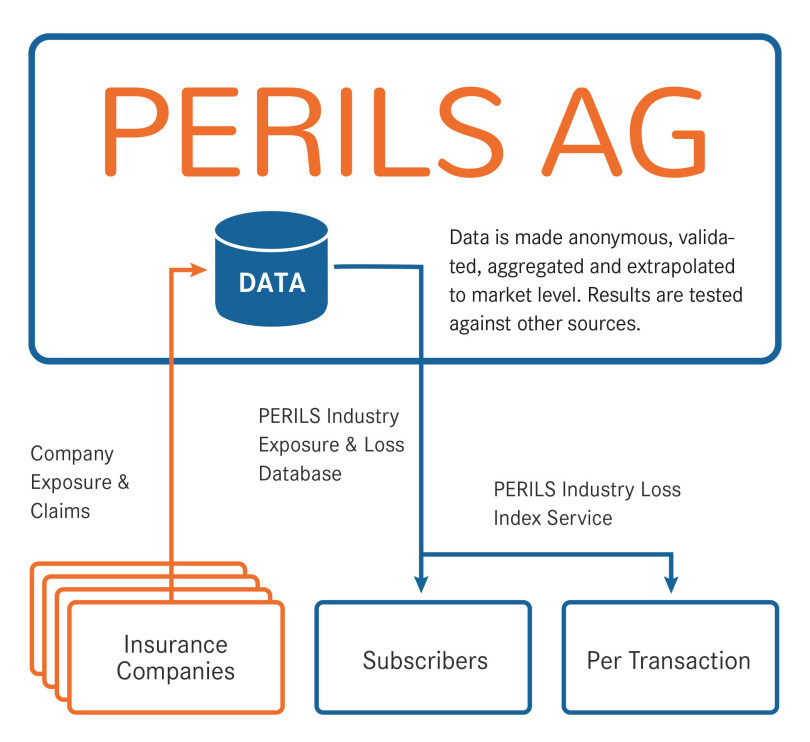

PERILS collects its data directly from insurance companies underwriting business in the covered territories. Data provision is based on a contractual agreement (the Data Provider Agreement) between PERILS and each of the data-providing insurance companies.

The data provided include exposure data (sums insured) by CRESTA zone and by country, property premium data by country, and event loss data by CRESTA zone and by country. This company data is made anonymous upon receipt and is tested for quality and completeness using standardized data quality and completeness checks. The data is then added to the data which has already been accepted within the identical aggregation units in the PERILS database. The original raw company data is deleted at this stage in compliance with applicable antitrust and competition laws.

Aggregated company data within the identical aggregation units is extrapolated to industry-level (i.e. market-level) using published market property premium information per country. The latter is broken down into individual aggregation units using population data and other proxy data. Company property premium data per country is broken down into individual aggregation units using average rates as derived from provided sums insured and premium data. The relationship between market premium and company premium then gives the market coverage per aggregation unit. The latter is used to extrapolate event loss data per aggregation unit to industry-level (i.e. market-level). The calculated industry event loss is subsequently tested against information from national authorities and insurance industry sources, as well as meteorological and other scientific data. This ensures the highest possible degree of data quality and realism.

It is important to note that the reverse engineering of PERILS industry data is not possible, i.e. the data providing sources cannot be reconstructed and their anonymity is assured.

Subscription

Access to the PERILS Industry Exposure & Loss Database is available on an annual subscription basis. Subscription is available per individual covered territory or for all covered territories combined.